The Emission Trading System is part of the European Union (EU)’s efforts to control greenhouse gases (GHGs). As a result of the Kyoto Protocol, the EU was obliged to reduce its collective GHG emissions. To do so, the EU adopted two paths: the ETS, and the Effort Sharing Decision (ESD – see entry in iePEDIA). The ETS was designed to control emissions from large carbon-polluting power and industrial plants, as well as the airline industry. For airlines, only emissions from flights within Europe are covered at the moment. The ESD was designed to control the emissions from other sectors of the economy.

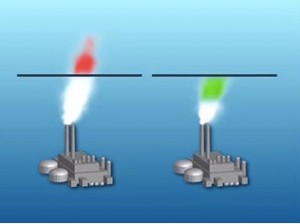

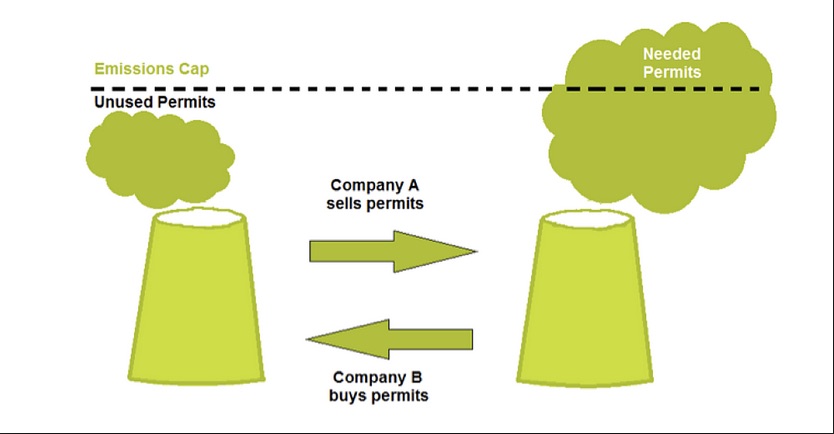

The carbon-pricing mechanism chosen for the ETS was a cap-and-trade system where a cap is set on the total amount emission from certain GHGs from the applicable entities for each year. The emissions are monitored. Each entity is allotted emission allowances that establish what levels of emissions each can emit, the total of which would not exceed the cap. If the company exceeds its allowances, it is liable to the EU for a substantial fine. If a company is energy efficient and emits less than what it has been allotted, then it can trade its excess allowances to other companies that are exceeding their allowances, and the latter pays the former for this trade. To promote further reduction in GHGS, the allowances are reduced over time forcing companies to eliminate carbon and other GHGs from their operations, or pay fines.

Similar systems are being tried in other places but the EU ETS is the largest of the cap-and-trade mechanisms. It covers 11,000 power stations and industrial plants in 31 countries, as well as airlines, and reaches 45% of the EU GHGs.

A critical problem for the ETS is that most allowances were given away free of charge at the beginning in 2005, largely to ease the burden on businesses in adapting to the new obligation. Then the recession hit everywhere and companies produced less energy and products, and emitted less so that they were able to horde large quantities of allowances. As a result the price of trading allowances fell sharply, undermining the ETS as an effective carbon pricing mechanism. If allowances were cheap, a company did not have to worry about reducing its GHGs as much as when prices were high. Lately companies have to purchase their allowances at auctions.

Some further ideas to explore on the EU ETS

While the companies subject to the ETS are regulated for certain GHGs, what about the other GHGs they emit, like methane. Are these other GHGs regulated from these companies through other means?

Are fracking operations subject to the ETS? How about other mining and drilling operations? If not, how are they regulated for GHGs?

Compare cap-and-trade systems with carbon taxes as carbon pricing mechanisms. Which is better, and how do you decide that?

Sources

European Commission, The EU Emissions Trading System (EU ETS): Fact Sheet (October 2013). ec.europa.eu/clima/publications/docs/factsheet_ets_en.pdf

European Commission, Climate Action: The EU Emission Trading System (EU ETS). ec.europa.eu/clima/policies/ets/index_en.htm

Effort Sharing Decision in iePEDIA section of irish environment magazine (August 2013). www.irishenvironment.com/iepedia/effort-sharing-decision-european-union/

No comments yet, add your own below