Introduction

The European Union (EU) and United States (US) are in the midst of negotiations, mostly secret, over a trade agreement called the Transatlantic Trade and Investment Partnership (TTIP). The basics to TTIP, and its attempts at “Environmental deregulation,” are discussed by John Hilary in the Commentary section of this issue (Feb 2015) of irish environment. Here we focus on the “investor-state dispute settlement” (ISDS) provision of the TTIP and what it means, should it be adopted. We then review a recent study by Friends of the Earth Europe that analyses 127 cases of investor-state dispute claims, under various existing inter-governmental trade agreements, their outcomes, and the implications for the ISDS under TTIP.

epthinktank.eu

Nature of the ISDS

Under pressure from citizens, environmental NGOs (eNGOs), and Members of the EU Parliament, the EU is now publishing certain documents related to the TTIP negotiations. Despite this improvement in the transparency of the process, much remains hidden behind close doors, including the exact terms of any proposed provision. We know that the devil is in the details, and we can only point out the general purposes of the ISDS, the typical terms, and repeated problems from other international trade agreements. That is enough to raise deep concerns about any ISDS.

An ISDS is a provision in international trade agreements that allows a company, or investor, to file a claim against a state, or sub-division [US state, EU Member] for loss of profits or other detrimental economic effects as a result of the state taking regulatory action. The dispute mechanism appears to cover any alleged breach of the agreement, broadly construed.

The claim is heard and determined by a panel of private arbitrators, there is no public participation, the proceedings are secret, and there is no appeal to any court. The final report by the arbitrators may be made public.

Commercial arbitration has been used successfully in disputes between two consenting commercial entities that have a dispute arising under a contract, course of dealings, or commercial relationship between them. But when one of the parties to the dispute is a political body, the game changes.

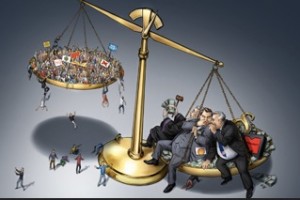

Under ISDS, the arbitrators are lawyers who have been trained in, and whose experiences are grounded on, the application of commercial law to disputes. Their private work has focused, often exclusively, on commercial law and their clients are usually commercial entities. Since companies always complain about governmental regulations diminishing their profits or otherwise interfering with the way they want to operate their business, commercial lawyers naturally tend to buy into these views. When these lawyers are hired to resolve a dispute between a company and a governmental entity, under an ISDS provision, the lawyer’s affinities, if not direct interests, are most often with the company.

snipview

It is not hard to see how private commercial arbitrators, operating in secrecy behind closed doors without any scrutiny from the public, would sympathise with business interests.

In contrast, a judge in a national court system has been trained in and relies on both contract law and public policy, which can, and sometimes should, inform disputes between investors and governmental entities. And of course the judge almost always, in non-criminal cases, operates in an open courtroom subject to scrutiny from the press and public, and their political representatives.

Finally, if a state loses a claim under ISDS, or makes a settlement, the investor recovers its claim from the government and the investment risk the company made is now passed on to the taxpayers. Even if the state prevails, it can be saddled with significant costs and fees for counsel. The Organisation for Economic Co-operation and Development (OECD) estimates that a single ISDS case amounts on average to $8 million for legal and arbitration fees alone.

Prior Experience with ISDS

While ISDS provisions have been widely used in bilateral investment treaties (BITs) in the past, this one is different. First, it applies to the largest trade agreement involving the US and EU, both major exporting economies. Earlier versions usually involved a large economy and a smaller one. Second, there is a growing body of legal cases and experiences revealing the weaknesses, and dangers, of the ISDS. Such dangers include the lack of transparency, or secrecy, of ISDS proceedings, and the narrow interests of the arbitrators as pointed out above. Third, one of the key rationales justifying the ISDS, in some eyes, is that smaller, less sophisticated legal systems often can be seen as unfair to, even punitive of, large international corporations and so these corporations need a level playing field, which they believe they get with commercial arbitrators. The US and EU hardly qualify as “undeveloped legal systems.” George Monbiot has pursued this issue, asking the US and EU representatives to point out the deficiencies of the US and EU legal systems that would justify an ISDS provisions. So far, there has been a loud silence.

Finally, the actual experiences of ISDS reveal concerted efforts by companies to undermine public policies and regulations on the grounds that the private companies have been prevented from advancing their own financial, private interests. The Friends of the Earth Europe study highlights this issue.

Some Numbers from the Study

The study reviewed 127 cases arising under the ISDS provisions of various trade agreements. Many cases under ISDS are kept secret and so limited information is available for such cases. Of the 127 cases, 75 involved environmental sectors. Of the 127 cases, 28 were successes for the investors, with 15 awards in favor of investors and 13 in settlements; 14 were in favor of the state; 18 cases had unknown outcomes; 21 were rejected or otherwise discontinued; and, 46 cases are still pending. The biggest award for investors was in the amount of £553 million against Slovak; the largest settlement for £2 billion was paid by Poland. Here we have private companies collecting millions to billions from states, and their citizens, based on secret proceedings ruled by private arbitrators.

Greenpeace

Some Case Studies

The big numbers do not reveal as much as the details, as they are known, from exemplary cases.

The largest settlement of £2 billion was paid by Poland to a Dutch company. Poland was privatising a formerly public-owned insurance company and the Dutch company had purchased about 30%, planning on eventually buying over 50% to control the company. But then the public vociferously objected when problems arose with health services, and the Polish government reversed the privatization. The Dutch company claimed it was denied the opportunity to purchase a larger share of the company, and claimed the losses amounted to £2 billion. In effect, the Polish people were forced to pay the equivalent of this amount because they found their health services suffering from the privatization and a private company was able to invoke an ISDS to by-pass Polish courts in determining the dispute.

Romania was subject to a claim, under an ISDS, by a Swedish company when Romania withdrew an investment incentive for the food processing industry. Romania had to do this in order to comply with the accession requirements of the EU. The European Commission interceded on Romania’s behalf arguing the action was required by Romania as it constituted unlawful state aid, under EU law. The arbitrators ignored the EU obligation and found that Romania’s obligations under the ISDS overrode EU obligations.

And now we find that the EU is pushing for an ISDS provision in the US agreement, seemingly undermining its own authority.

Another Swedish energy company, Vattenfall, filed a claim against Germany with regard to the construction of a coal-fired power plant. A provisional contract was granted by the City of Hamburg in 2007, which established a number of environmental limitations to protect the Elbe River. Then to comply with the EU Water Framework Directive, the city added additional restrictions to the treatment of waste waters from the plant in 2008 before final approval was given to the contract. Vattenfall claimed under an energy treaty that the restrictions made its project “unviable,” i.e., more costly, and sued for €1.4 billion, plus interest and costs. The city settled the case in 2011 by lowering the environmental standards in line with the company’s demands. So restrictions that protected the river and were required by the Directive were ignored so that the company could make whatever profit it planned for. One wonders whether the City would have been liable to a suit by citizens for violating the Directive by lowering the environmental protections for the benefit of the company and to the detriment to the health of the citizens of the city?

In what may be the most galling, and worrisome, case, the same Swedish energy company, Vattenfall, has claimed €4.7 billion over the closure of two nuclear power plants pursuant to Germany’s decision to phase out nuclear energy following the disaster at Fukushima, Japan.

It does not take any imagination to see that claims under ISDS will be lodged against any party, such as France, that dares ban fracking, on the grounds that the ban will hurt the anticipated profits of the fossil fuel industry.

Other Unsettling Stories from George Monbiot

Besides the focused study by Friends of the Earth Europe on the case outcomes under ISDS, George Monbiot of The Guardian has pointed out other disturbing examples. Australia passed a requirement that cigarettes had to be sold only in plain packets, marked with shocking health warnings. The requirement followed massive debates in the Parliament and in public, and it was validated by the Australian Supreme Court. Nevertheless, Philip Morris has filed a claim under a trade agreement that the requirement violates its intellectual property rights, in the process undermining the Parliament and Supreme Court of Australia.

Argentina was sued by international energy companies when it imposed a freeze on people’s energy and water bills. The citizens were angry at the vast rise in their energy bills, caused by the very companies suing Argentina. The companies recovered over a billion dollars.

Finally, in El Salvador local communities organised and persuaded the government to refuse permission for a large gold mine that threatened to pollute their water supplies. Three of the citizens were murdered during the campaign. The Canadian mining company is now suing El Salvador for $315 million for loss of anticipated future profits. One wonders whether there was any redress for the murdered citizens. See Russell Brand Talks to George Monbiot video (sources).

Conclusion

The Trojan Horse metaphor used by the Friends of the Earth Europe is apt. As a metaphor, it refers to a trick that allows an enemy to infiltrate the protected arena of a foe. Without putting too fine a point on it, the enemies are the foreign or multinational corporations and the states. The corporations view the states as blocking their path to greater glory, a/k/a profits. Having tried direct assaults (blocking regulations or legislation by the state), to no avail, the corporations try to sneak into the state’s legal regime by slipping the seemingly innocuous arbitrators into that regime. Once in, the arbitrators will deliver what the corporations most want – more profits.

What remains missing from the analyses of the ISDS is a comparison of what would happen with the kinds of disputes reviewed by Friends of the Earth Europe, and others, if they ended up in a court of the EU or US as opposed to being handled by ISDS arbitrators.

Certainly the legal regimes of the EU and US provide well-known and adequate protections for their citizens and companies. The EU and US have transparent, fully developed and tested rules of law, covering rights of ownership, equal treatment, intellectual property, contractual relations, and almost every conceivable legal issue. These procedural and substantive protections are available to domestic and foreign companies, unlike the ISDS, which provides its advantages only to foreign investors.

George Monbiot has been trying to get an answer as to the problems of the EU and US legal systems that ISDS is supposed to correct. We’re all waiting for an answer. Is the European Commission really prepared to trash talk Europe’s legal regime, in order to satisfy the demands of large multi-national corporations? That would be a dangerous course of action at this tumultuous time.

Sources:

Emma Jayne Geraghty, Natacha Cingotti, Friends of the Earth Europe, Stop the Trojan Treaty: The hidden cost of EU trade deals: Investor-state dIspute settlement cases taken against EU member states (4 Dec 2014). www.foeeurope.org/hidden-cost-eu-trade-deals

John Hilary, The Transatlantic Trade and Investment Partnership: A Charter for Deregulation, An Attack on Jobs, An End to Democracy (February 2014). rosalux.gr/sites/default/files/publications/ttip_web.pdf

See Commentary by John Hilary in this (Feb 2015) issue of irish environment magazine on the TTIP and its attempts at environmental deregulation.

John Hilary, War on Want, TTIP waronwant.org/campaigns/trade-justice/ttip

George Monbiot, “This transatlantic trade deal is a full-frontal assault on democracy,” The Guardian (4 Nov 2013). www.theguardian.com/commentisfree/2013/nov/04/us-trade-deal-full-frontal-assault-on-democracy

See video: Russell Brand Talks To George Monbiot About TTIP – Who Does David Cameron Really Work For? www.youtube.com/watch?v=Rh0InepmCwQ

Elizabeth Grossman, “Report: transatlantic trade agreement could increase toxic pesticide use,” The Guardian (7 Jan 2015). www.theguardian.com/sustainable-business/2015/jan/07/ttip-trade-agreement-pesticides-toxics-health-environment

Ian Traynor, “TTIP divides a continent as EU negotiators cross the Atlantic,” The Guardian (8 Dec 2014). www.theguardian.com/business/2014/dec/08/transatlantic-trade-partnership-ttip-dividing-europe-cecilia-malmstroem-washington-debut

Kevin Albertson, “Europe faces weapons of legal destruction in USA trade talks,” The Conversation: Academic rigor, journalistic flair (7 Nov 2014). theconversation.com/europe-faces-weapons-of-legal-destruction-in-usa-trade-talks-33964

Damian Carrington, “MPs to investigate TTIP trade deal’s impact on environmental protections,” The Guardian (9 Jan 2015). www.theguardian.com/environment/2015/jan/09/mps-investigate-ttip-trade-deals-impact-on-environmental-protections

Sierra Club, The Transatlantic Free Trade Agreement: What’s at Stake for Communities and the Environment (June 2013). action.sierraclub.org/site/DocServer/TTIP_Report_2.pdf?docID=13561

Ilana Solomon, Sierra Club, “Corporations Aren’t People And They Aren’t Nation States, Either” (3 Nov 2014). blogs.sierraclub.org/compass/2014/11/corporations-arent-people-and-they-arent-nation-states-either.html?utm_source=feedburner&utm_medium=feed&utm_campaign=Feed%3A+compass-main+%28Compass+-+Main%29

No comments yet, add your own below