When we charge ourselves for our use of the environment and public resources, we use them with care. When we allow us ourselves to use them for free, we over-use the environment, and we waste resources. The idea of environmental taxation – which includes charges and levies – is to impose these charges on ourselves, and reduce the pressure we put on the environment.

When the revenue collected from such taxes is used to reduce or avoid other taxes, this is called ‘Environmental Tax Reform’. The amount of taxes raised on things that are bad for us and we want to discourage, such as pollution, is compensated by reducing or avoiding taxes on employment and investment that we want to encourage. Under certain conditions, we get a double dividend – improved environmental quality and a better performing economy.

The European Environment Agency (EEA) recently decided to focus on an individual member state – Ireland — that is struggling with budget deficits, and go into some detail as to the specific national opportunities as regards environmental tax reform.

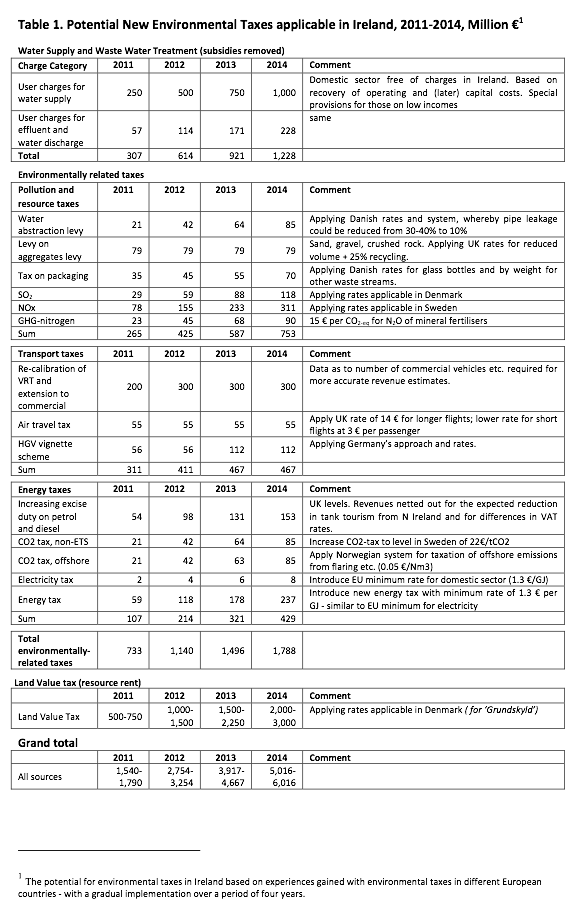

Several experts in the application of environmental taxes came to Dublin to present details of their experience.(1) A number of opportunities were identified where environmental performance could be significantly improved, while at the same time revenues could be generated.(2) Some of the opportunities that were presented that are of direct relevance to the situation in Ireland are listed with a comment on the potential they present in Table 1, below. The below proposals would provide a significant relief up to €5 billion for the budget.

Environmental taxation already has widespread application in Ireland. The poster child of this approach is the plastic bag levy, which reduced the use of such bags in Ireland by over 90 per cent within a week of its introduction. However, Ireland also recently introduced a CO2 tax for the part of fossil fuel use not subject to emissions trading with carbon allowances.

The ‘polluter pays’ principle’ is fair in the sense that it charges most those who use most. It is manifestly unfair that a pensioner living alone who uses water vary sparingly subsidises the rich who use water prodigally. And the same applies to the use of energy, emissions of air pollutants, land use etc – without charging, the poor subsidise the rich. And in general, unless environment and resources are priced, the rich will always benefit as they use more ‘stuff’ and services of all sorts.

But it is the case that even though poor people impose much less on the environment than the rich, the poorest will still be stressed financially to pay the charges. In such cases, they should be given the means to reduce their consumption – in the case of water there are very low cost investments (less than €100) that will have an immediate effect – and they should get either a green check or a small free allocation.

In the case of business, the quid pro quo in these difficult times where everyone must pay more taxes and endure a reduction in public services, is that business pay for the impositions it makes on the publicly-owned environment. Also, such environmental taxes will support the emergence of a new generation of clean tech businesses whose financial and employment model depends on such charges being imposed.

Notes

(1) Dublin Stakeholder Event “Environmental Tax Reform: Learning from the past and reinventing the future” Oct. 29th 2010 www.comharsdc.ie/events/event_details.aspx?Event=37.

(2) Further environmental tax reform – its illustrative potential in Ireland based on established practices across Europe, EEA staff paper 2010. www.comharsdc.ie/files/2010_BriefingNoteETRWorkshopDublin%20_pap.pdf

This article is a modified, shortened version by staff at the European Environment Agency of a Commentary by Professor Frank Convery, Chairperson of Comhar Sustainable Development Council (SDC) and Director of the Earth Sciences Institute, University College Dublin. The work is based on a conference on Environmental Tax Reform – organised by Comhar SDC in collaboration with the European Environment Agency, UCD Earth Sciences Institute, Smart Taxes and Feasta – which took place in Dublin on 28th and 29th October 2010. Frank Convery’s Commentary on ETR and the conference can be found at www.comharsdc.ie/blog/?m=201011

Related EEA publications

Using the market for cost-effective environmental policy, EEA report 1/2006. www.eea.europa.eu/publications/eea_report_2006_1

Market-based instruments for environmental policy in Europe, EEA Technical Report 8/2005. www.eea.europa.eu/publications/technical_report_2005_8

Environmental taxes – recent developments in tools for integration, Environmental issue report 18/2000. www.eea.europa.eu/publications/Environmental_Issues_No_18

Environmental taxes – implementation and environmental effectiveness, Environmental issue report 1/1996. www.eea.europa.eu/publications/92-9167-000-6

Admiring the persistence you put into your site and in depth information you provide. It’s good to come across a blog every once in a while that isn’t the same outdated rehashed information. Wonderful read! I’ve bookmarked your site and I’m including your RSS feeds to my Google account.